Getting started#

Quick start#

Cashflower is an open-source Python framework for actuarial cash flow models.

Prerequisites#

To use cashflower, you need Python version >=3.9.

Installation#

Cashflower is available on python Package Index (PyPI). You can install it with the pip tool.

pip install cashflower

Create model#

Start your project with creating a new model. You can create multiple models for each product that you work on.

Pass on the name when creating the model, e.g. wol.

from cashflower import create_model

create_model("wol")

The create_model() function creates an initial structure of the model.

.

├── input.py

├── model.py

├── run.py

└── settings.py

The initial structure consists of the input.py, model.py, run.py and settings.py scripts.

Input#

In the input.py script, you can define runplan, model point sets and assumptions.

import pandas as pd

from cashflower import Runplan, ModelPointSet

runplan = Runplan(data=pd.DataFrame({

"version": [1],

"valuation_year": [2022],

"valuation_month": [12]

}))

main = ModelPointSet(data=pd.read_csv("C:/my_data/policy.csv"))

assumption = dict()

assumption["interest_rates"] = pd.read_csv("C:/my_data/interest_rates.csv")

assumption["mortality"] = pd.read_csv("C:/my_data/mortality.csv", index_col="age")

Runplan bases on the Runplan class, model point sets base on the ModelPointSet class and assumptions have a form of a dictionary.

Model#

The model.py script contains the logic of the model. You can define model variables there.

from cashflower import variable

@variable()

def age(t):

if t == 0:

return int(main.get("AGE"))

elif t % 12 == 0:

return age(t-1) + 1

else:

return age(t-1)

@variable()

def death_prob(t):

if age(t) == age(t-1):

return death_prob(t-1)

elif age(t) <= 100:

sex = main.get("SEX")

yearly_rate = assumption["mortality"].loc[age(t)][sex]

monthly_rate = (1 - (1 - yearly_rate)**(1/12))

return monthly_rate

else:

return 1

The variables defined in model.py will be calculated and saved in the output.

Calculate#

To calculate the model, run run.py.

cd wol

python run.py

This command will create the model’s output.

Model overview#

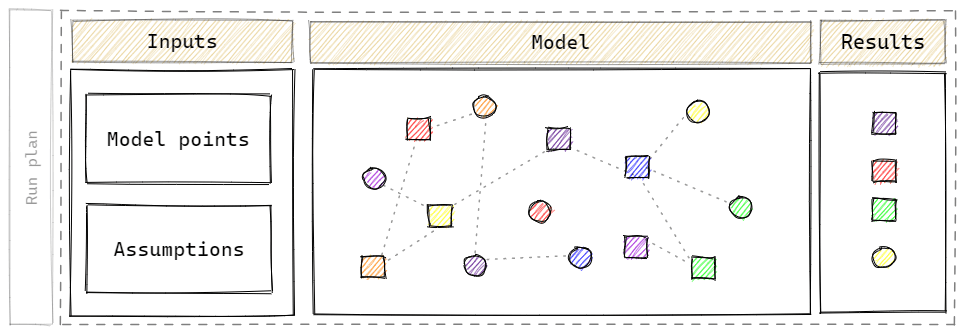

Actuarial models help to predict future cash flows of insurance products.

- The main components of an actuarial model are:

model point sets,

assumptions,

runplan,

model variables,

results.

Run plan - run plan is a list of runs that we want to perform with the model.

Model point sets - points of data for which the model is calculated. For example, a model point can contain policyholder’s attributes such as age, sex, premiums, coverage, etc. Model point sets can be split into separate files. For example, there might be separate files for fund and coverage data.

Assumptions - actuarial models are calculated based on assumptions. Examples of underwriting assumptions include mortality, lapses or expenses. Market assumptions are, for example, interest rates curves. Assumptions are also product’s parameters, such as fees or levels of guarantees.

Model - actuarial model reminds a spider’s web. There are many variables which dependent on each other.

Model variables - functions that depend on the projection’s period.

Results - the output of the calculation logic.

Time#

Actuarial cash flow models try to predict the future. The results are put on a timeline with future dates.

Time variable t plays an import role.

Timeline#

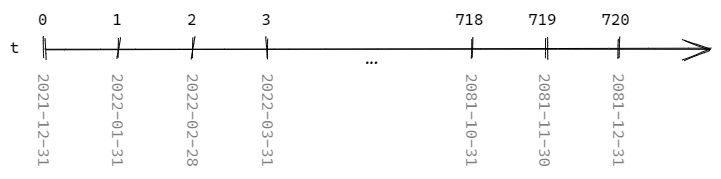

Timeline starts at zero (t=0) which is the valuation period.

If the reporting period is the end of year 2021, then t=0 is 2021-12-31.

- The

tvariable reflects certain point in time. The projections are monthly so: t=1is 2022-01-31,t=2is 2022-02-28,t=3is 2022-03-31,…

Periods#

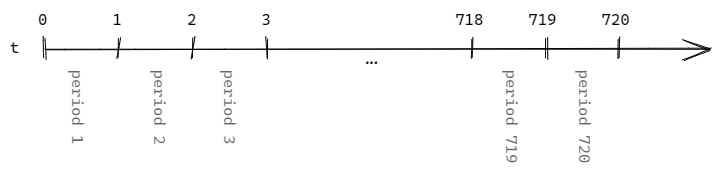

Some components of the model concern periods rather than points in time.

In these cases, the t variable has a different meaning.

Warning

The t variable might mean a point in time as well as a period.

For example, interest rates curve helps to calculate the value of money in time.

If the monthly rate amounts to 0.1% then €100.00 at the end of February is worth €100.10 at the end of March.

The assumption can be presented in the following way:

t |

rate |

|---|---|

… |

… |

3 |

0.001 |

… |

… |

The rate is applied to a third period.

Moment in month#

By default, t reflects the end of the month.

If cash flows in different moments of the month, it can be reflected using discounting.

Tip

Use the right discounting if the cash flow does not happen at the end of the month.

For example, there are premiums occurring in the middle of the month.

Then use if interest rate is i, use (1/(1+i))**(1/2) for discounting.