Model#

The model.py script contains the definitions of model variables, which serve as the core components

of the actuarial cash flow model, encapsulating its logic.

@variable()

def my_variable(t):

...

To define a model variable, follow two steps:

Define a function with the

tparameter (or no parameters) that returns a numeric value.Decorate the function with

@variable().

A cash flow model variable is a variable that returns a numeric value for a future periods.

In the following sections, we will discuss model variables in the context of time dependence and aggregation type.

Time dependence#

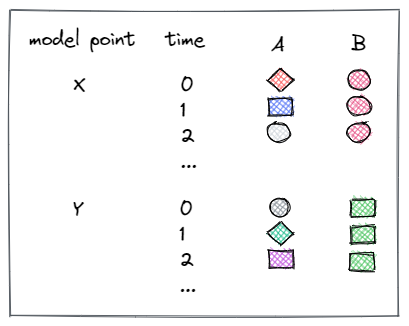

Model variables produce results per model point and time.

Regarding time dependence, there are two types of variables:

A - time-dependent variable,

B - constant variable.

Both types are described further in the sections below.

Time-dependent variable#

To define a time-dependent variable, create a function with the parameter t

and add the @variable() decorator.

@variable()

def cal_month(t):

if t == 0:

return runplan.get("valuation_month")

if cal_month(t-1) == 12:

return 1

else:

return cal_month(t-1) + 1

The variable can be called inside of another variable.

For example:

@variable()

def cal_year(t):

...

cal_month(t-1)

...

Constant variable#

To define time-independent variables, create a function without any parameters and add the @variable() decorator.

@variable()

def elapsed_months():

issue_year = main.get("issue_year")

issue_month = main.get("issue_month")

valuation_year = runplan.get("valuation_year")

valuation_month = runplan.get("valuation_month")

return (valuation_year - issue_year) * 12 + (valuation_month - issue_month)

Constant variables, like elapsed_months, maintain a consistent value throughout the projection,

making them independent of time. These variables do not require any arguments when called.

For example:

@variable()

def pol_month(t):

...

mnth = elapsed_months() % 12

...

Constant variables are particularly useful for storing information that remains unchanged over time.

Aggregation type#

The actuarial cash flow model calculates results across multiple model points. By default, the model sums the results, which suits most variables, like financial cash flows such as premiums or expenses.

For instance, consider this default behavior in the model variable definition:

@variable()

def my_variable(t):

...

It’s equivalent to specifying the aggregation type as sum:

@variable(aggregation_type="sum")

def my_variable(t):

...

However, certain results, like interest rate curves or projection years, lose their significance when summed.

In such cases, you can specify an alternative aggregation type for a variable.

For instance, to use only the results of the first model point,

set the aggregation_type parameter within the @variable() decorator to "first":

@variable(aggregation_type="first")

def my_variable(t):

...

This configuration ensures that the output includes values solely from the first model point.