Time#

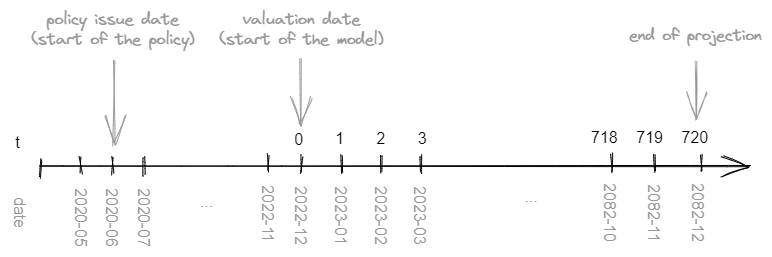

The time variable (t) is a system variable in actuarial cash flow models.

The t variable represents monthly periods starting from zero.

The model is run for the valuation date chosen by the actuary.

The valuation date reflects the start of the model (t=0).

The information on the valuation date can be stored in the runplan.

Below you can find model formulas for time-related variables that might be helpful in the model’s development.

Solution#

Formulas:

import math

from cashflower import variable

from input import main, runplan

@variable()

def cal_month(t):

if t == 0:

return runplan.get("valuation_month")

if cal_month(t-1) == 12:

return 1

else:

return cal_month(t-1) + 1

@variable()

def cal_year(t):

if t == 0:

return runplan.get("valuation_year")

if cal_month(t-1) == 12:

return cal_year(t-1) + 1

else:

return cal_year(t-1)

@variable()

def elapsed_months():

issue_year = main.get("issue_year")

issue_month = main.get("issue_month")

valuation_year = runplan.get("valuation_year")

valuation_month = runplan.get("valuation_month")

return (valuation_year - issue_year) * 12 + (valuation_month - issue_month)

@variable()

def pol_month(t):

if t == 0:

mnth = elapsed_months() % 12

mnth = 12 if mnth == 0 else mnth

return mnth

if pol_month(t-1) == 12:

return 1

return pol_month(t-1) + 1

@variable()

def pol_year(t):

if t == 0:

return math.floor(elapsed_months() / 12)

if pol_month(t) == 1:

return pol_year(t-1) + 1

return pol_year(t-1)

Input:

import pandas as pd

from cashflower import Runplan, ModelPointSet

runplan = Runplan(data=pd.DataFrame({

"version": [1],

"valuation_year": [2022],

"valuation_month": [12]

}))

main = ModelPointSet(data=pd.DataFrame({

"id": [1],

"issue_year": [2020],

"issue_month": [6],

}))

Description#

Input#

Model uses runplan to store the information on the valuation date.

import pandas as pd

from cashflower import Runplan, ModelPointSet

runplan = Runplan(data=pd.DataFrame({

"version": [1],

"valuation_year": [2022],

"valuation_month": [12]

}))

The policyholder has a policy that was issued in June 2020.

main = ModelPointSet(data=pd.DataFrame({

"id": [1],

"issue_year": [2020],

"issue_month": [6],

}))

Model#

Calendar year and month

Knowing the valuation date, we can calculate actual calendar years and months. The valuation year and month can be read from the runplan.

@variable()

def cal_month(t):

if t == 0:

return runplan.get("valuation_month")

if cal_month(t-1) == 12:

return 1

else:

return cal_month(t-1) + 1

@variable()

def cal_year(t):

if t == 0:

return runplan.get("valuation_year")

if cal_month(t-1) == 12:

return cal_year(t-1) + 1

else:

return cal_year(t-1)

Elapsed months

Each policy starts at a different moment. The policy’s issue date might be part of the model points. Elapsed months reflect how many months have passed between the policy’s issue and the valuation date.

@variable()

def elapsed_months():

issue_year = main.get("issue_year")

issue_month = main.get("issue_month")

valuation_year = runplan.get("valuation_year")

valuation_month = runplan.get("valuation_month")

return (valuation_year - issue_year) * 12 + (valuation_month - issue_month)

Policy year and month

Policy year and month reflect the duration of the given policy.

@variable()

def pol_month(t):

if t == 0:

mnth = elapsed_months() % 12

mnth = 12 if mnth == 0 else mnth

return mnth

if pol_month(t-1) == 12:

return 1

return pol_month(t-1) + 1

@variable()

def pol_year(t):

if t == 0:

return math.floor(elapsed_months() / 12)

if pol_month(t) == 1:

return pol_year(t-1) + 1

return pol_year(t-1)

Results#

The result for the first 13 months.

t,cal_year,cal_month,elapsed_months,pol_year,pol_month

0,2022,12,30,2,6

1,2023,1,30,2,7

2,2023,2,30,2,8

3,2023,3,30,2,9

4,2023,4,30,2,10

5,2023,5,30,2,11

6,2023,6,30,2,12

7,2023,7,30,3,1

8,2023,8,30,3,2

9,2023,9,30,3,3

10,2023,10,30,3,4

11,2023,11,30,3,5

12,2023,12,30,3,6

13,2024,1,30,3,7

- Notes:

cal_month,cal_year- starts with valuation date,elapsed_months- number of months between issue of the policy (2020-06) and the valuation date (2022-12),pol_month,pol_year- the policy was already 2 years and 6 months “old” at the valuation date.